Diversification strategy

Principles

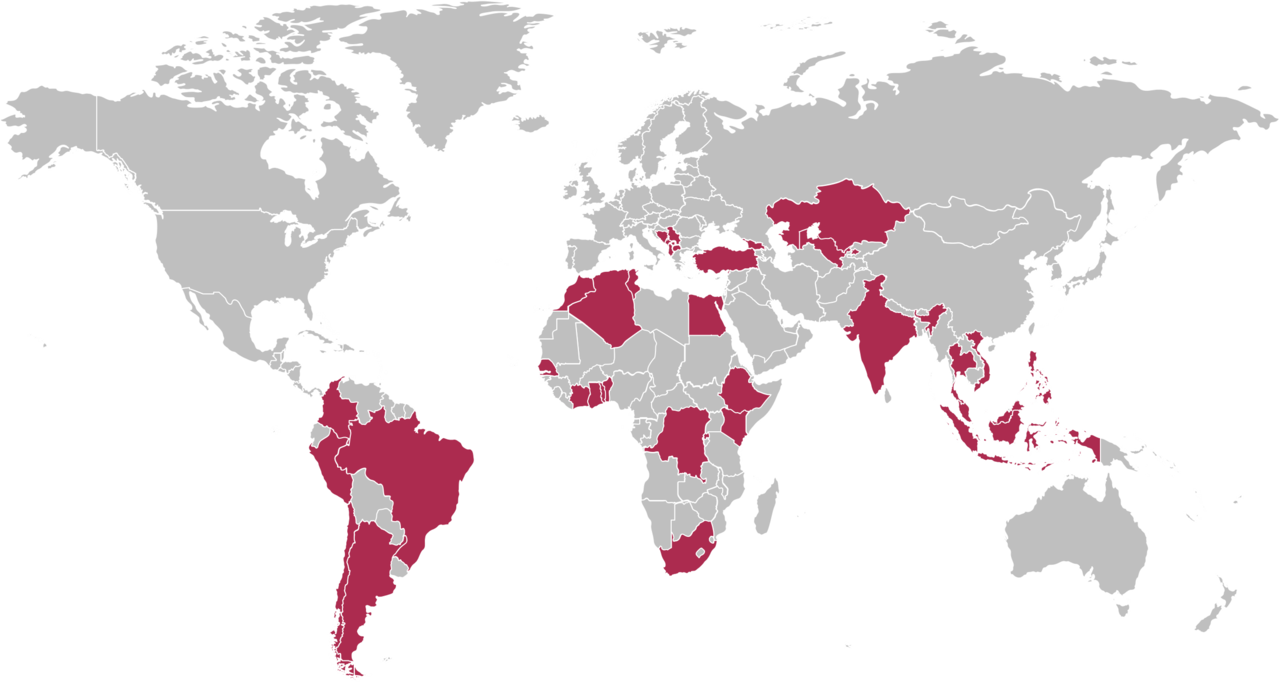

The Federal Government provides incentives for diversification of foreign trade relations and offers preferential conditions for the assumption of investment guarantees in selected diversification targets, including both individual countries and groups of countries such as the Western Balkans and the members of the CwA initiative (see map below). The aim is to support German enterprises even more effectively in opening up new markets. The incentives are differentiated according to the respective OECD country risk category. A review of the incentives and target countries will take place after 5 years in autumn 2028.

The following incentives apply to projects in the selected countries:

- Waiving of the application fee

- Reduced deductible in case of damage (2.5 % instead of 5 %)

- Annual guarantee premium reduced by 10 % (countries in OECD country risk category 1-5)

The benefits apply to a geographically balanced number of investment destinations that offer good conditions for German enterprises but have been less in the focus of business so far and play a minor role in the portfolio of investment guarantees. Against this background, countries were selected that particularly stood out as partners for German foreign trade, as transformation partners, as foreign policy partners in a rules-based global order or as emerging economic partners, taking into account economic and foreign policy criteria. A review of the incentives and target countries will take place after 5 years in autumn 2028:

Diversification targets by region

- German version only

Europa

Turkey, Western Balkans (Albania, Bosnia and Herzegovina, Kosovo, Montenegro, North Macedonia, Serbia)

[1] If further countries join the CwA initiative over time, they would be automatically included - irrespective of the regular review of the country list. CwA countries that are suspended as members of the African Union do not qualify as diversification targets.

Guarantee requirements

The basic guarantee requirements continue to apply for the granting of cover, i.e. the country is generally open for cover, there is a reliable basis for legal protection, the project is eligible for cover according to the criteria of the investment guarantees and the justifiability of the risk for the granting of a guarantee is ensured.

In addition, the latest cover policy decision for the respective country must be taken into account. This can be found on the respective country page on the website. Due to the challenging economic and/or political situation in countries classified as OECD risk categories 6 and 7, guarantees may only be granted to a limited extent there, e.g. by limiting certain risks (e.g. conversion and transfer risks) or excluding them completely from the guarantee. [1]

[1] The applicable compliance regulations are also relevant for investments in diversification targets; enhanced due diligence obligations may apply with regard to FATF listing, HRTC listing and the EU list of non-cooperative countries and territories for tax purposes, among others.

Interaction of the climate strategy and the diversification strategy

The diversification strategy goes hand in hand with the climate strategy for the federal guarantee instruments. A cumulation of incentives is possible, whereby the guarantee premium can be decreased to 0.4 % p.a. This results in particularly attractive conditions for investments in renewable energies, transformation technologies and climate-friendly showcase projects in the countries benefiting from the diversification strategy.

Spread risk

As part of the diversification strategy, a moderate but targeted tightening of the cover conditions for countries where there is an excessive concentration of covered projects is also taking effect: In countries with a share of more than 20% of the total investment guarantee cover volume, the annual guarantee premium was increased from 0.50% to 0.55% of the covered investment volume (DIA Report No. 42).

Moreover, a hedging limit of a maximum of three billion euros per company and target country was introduced (so-called coverage ceiling), whereby the values of affiliated companies are added together (group consideration). Exceptions are only possible in certain, narrowly defined cases, provided there is a special strategic national interest. This hedging limit corresponds to about 10% of the current total cover volume of the investment guarantees. It is to be reviewed every three years and adjusted if necessary. By introducing the cover ceiling, risks are spread more widely. Existing guarantees above the cover ceiling will only be extended for a transitional period and under stricter conditions.